Upgrade Your HDB to a Condo

Build your Asset Portfolio Progressively; Create a Savings Plan through Real Estate

Let us show you that it is possible to:

Upgrade to a condo without forking any extra cash from your own pocket

Upgrade to a condo yet with RESERVED FUNDS in Cash for rainy days

Upon upgrade of condo, having the sufficient funds for mortgage payment

Spot condos with good potential growth & good rentability factors

Grow your Principal & Passive Incomes via real estate

Sell and buy your next property strategically; & Grow your asset wealth progressively

Why not consult us and get our free planning and consultation today?

Learn from our accredited asset strategists with over a decade of experience.

Grow Your Asset Wealth

Can I Really … ?

upgrade without chunking out extra cash from own pocket?

I think it would be risky… Would the price drop after I purchase?

I don’t want to stretch my financial commitments… What if I lost my job?

Is NOW the RIGHT time to sell/buy? Would I be entering the market during Peak and over-pay?

Which development should I choose?

Is there a good resale market in that area?

Our Expertise & Experience can address your CONCERNS

GET IN TOUCH

Let Our experience & vast networks Work for You.

Contact Us

Get In Touch

Let Our Experience & Vast Network Work for You

Learn How To Avoid The ‘Property Trap’ !

Is Your HDB still an ‘ASSET‘ or fast becoming a ‘LIABILITY‘?

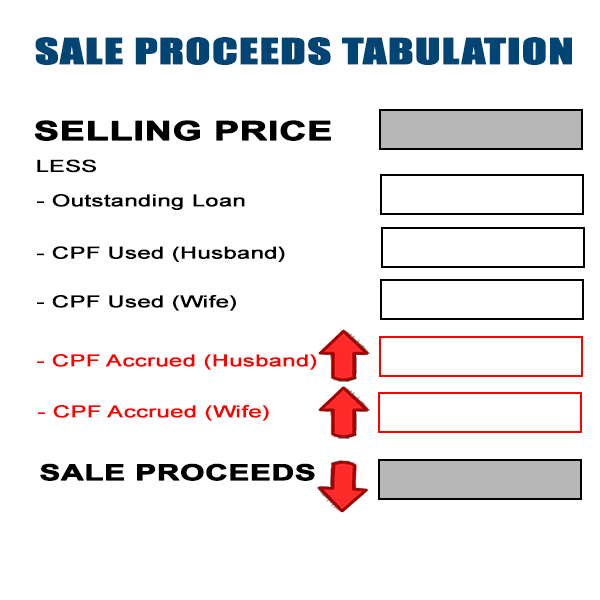

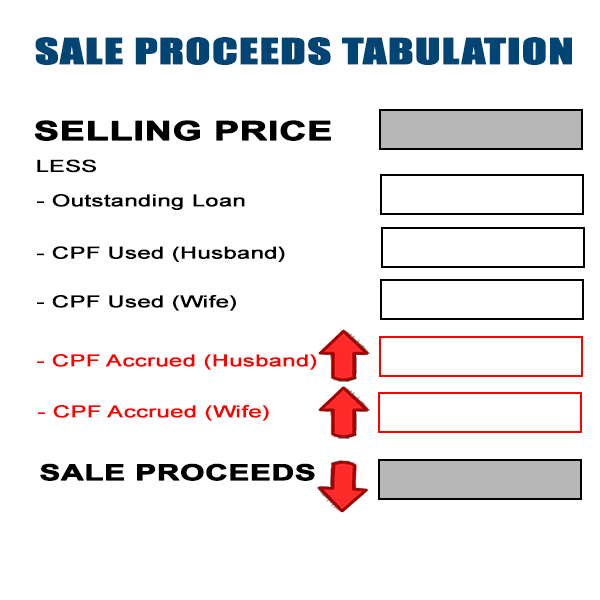

Most HDB homeowners not aware that the incorrect use of CPF had been steadily draining away their retirement savings …

Only upon having the intention to sell and started calculating their estimated sale proceeds that they realized locking their CPF in their HDB was ‘eating’ away their wealth!

Don’t let this ‘Hidden Trap’ hamper your ability to grow your property wealth and retirement savings!

Most HDB homeowners not aware that the incorrect use of CPF had been steadily draining away their retirement savings …

Only upon having the intention to sell and started calculating their estimated sale proceeds that they realized locking their CPF in their HDB was ‘eating’ away their wealth!

Don’t let this ‘Hidden Trap’ hamper your ability to grow your property wealth and retirement savings!

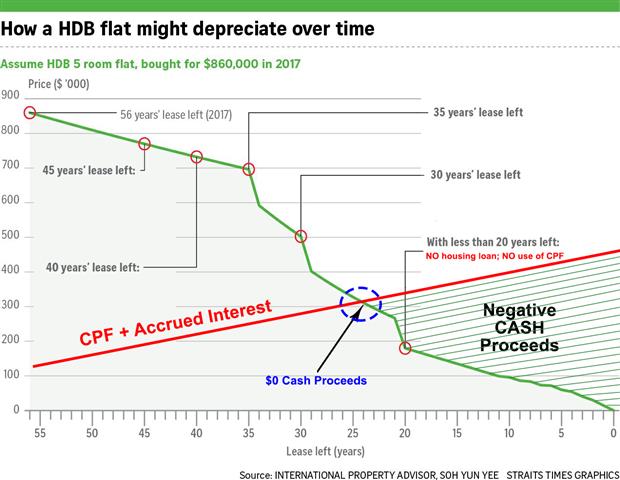

Assuming your HDB flat prices depreciate over time, but your CPF utilitized for the purchase will have interest accrued…

Over time, the flat price intersect with the utilized CPF + Accrued Interest to enter the zone of NEGATIVE CASH PROCEEDS !

Your HDB can’t help with your ‘Retirement Plan‘…

Let’s take a look at a simple illustration..

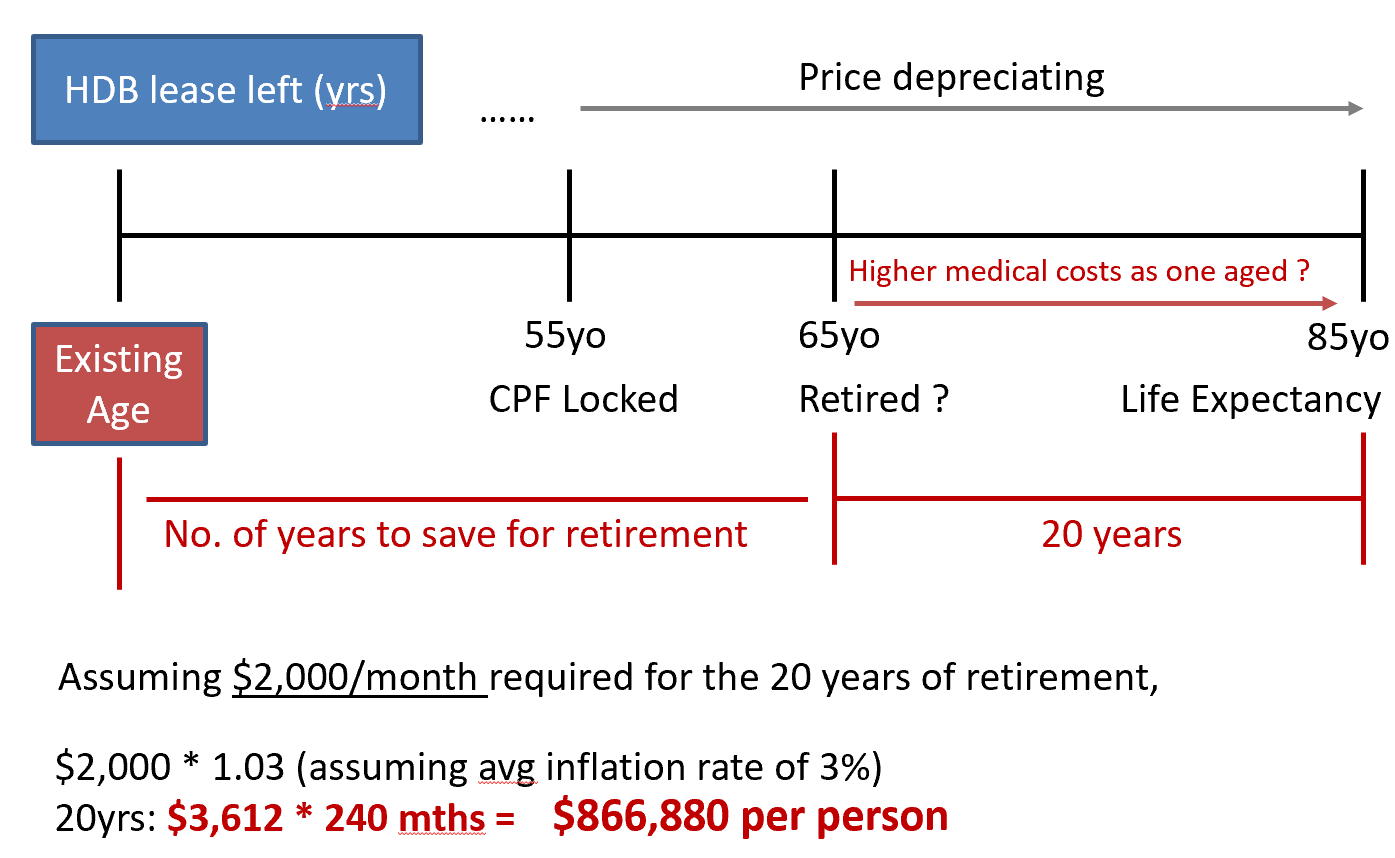

Assuming a couple retires at age of 65, and requires approximately $2,000 per month for their 20 years of retirement life till 85 years old.

And assuming inflation rate remains 3% per annual throughout the 20 years.

1. HDB prices depreciate over time i.e. value getting lesser over time.

2. Higher medical cost as one aged i.e. expenses go up every year as one aged

Now take out your smartphone…

Open the calculator, input 2000 * 1.03

Tap on the “=” 20 times (for the equivalent inflation value for 20 years)

Then multiply by 240 (240 months)

That’s more than $850,000 per person!

Do you think they could fetch a sale proceed of more than $1.6M that is required for their retirement funds?

Note that NO using of CPF savings, NO bank loans, and NO HDB loans will be granted to fund the purchase of flats with 20 years or less left on the lease.

gain CLARITY of your current situation NOW

© John Koh CEA Reg No. R002315B | All Rights Reserved

Wouldn’t it be a waste when you could upgrade comfortably, but did not?

case study 1:

From HDB To Condo

Mr. and Mrs. Eu owns a 4-room HDB flat. They intended to sell their 4-room flat to upgrade to a bigger resale flat.

After Our Consultation:

We did an in-depth analysis and detailed calculation and showed them an achievable asset progression roadmap.

The couple have since upgraded to a Condo, without touching any of their cash savings, and even got cash reserve of $170k (the safety net we had calculated for them)! Mr & Mrs Eu is planning for their 2nd condo to grow their asset portfolio, following the progression roadmap we had planned for them.

case study 1:

From HDB To Condo

Mr. and Mrs. Eu owns a 4-room HDB flat. They intended to sell their 4-room flat to upgrade to a bigger resale flat.

After Our Consultation:

We did an in-depth analysis and detailed calculation and showed them an achievable asset progression roadmap.

The couple have since upgraded to a Condo, without touching any of their cash savings, and even got cash reserve of $170k (the safety net we had calculated for them)! Mr & Mrs Eu is planning for their 2nd condo to grow their asset portfolio, following the progression roadmap we had planned for them.

case study 2:

From 1 to 2 Condos

Mr. and Mrs. Chua wanted to sell their 2-bedroom condo to upgrade to a 3 bedder.

After Our Consultation:

We did an in-depth analysis and detailed calculation and showed them an achievable asset progression roadmap.

We proposed another asset progression strategy for Mr & Mrs Lee after analysing they can actually achieve more.

Mr & Mrs Lee upgraded their Condo, and bought another smaller condo.

They are paying lesser in their mortgage loan than they would have if they had proceeded with their original plan – thanks to the passive rental income from the 2nd property.

case study 2:

From 1 To 2 Condos

Mr. and Mrs. Chua wanted to sell their 2-bedroom condo to upgrade to a 3 bedder.

After Our Consultation:

We proposed another asset progression strategy for Mr & Mrs Lee after analysing they can actually achieve more.

Mr & Mrs Lee upgraded their Condo, and bought another smaller condo.

They are paying lesser in their mortgage loan than they would have if they had proceeded with their original plan – thanks to the passive rental income from the 2nd property.

You Could Do the Same…

wait or miss out…

Let's meet up for a FREE Discussion NOW

You Could Do the Same…

wait or miss out…

Knowing what you not aware of could be hurting you financially… Property with appreciated value is mere numbers with the money stuck in the asset.. but worry not, because we will personally help you understand the current market and how to profit even when the market is gloomy… Like right now!

In fact, it’s dire times like this that true wealth is made. The market uncertainty may sound scary to you, but with ‘tested & proven’ strategies… we are able to assist in positioning you to make the right move to secure your future.

Let's meet up for a FREE Discussion NOW

What You Will Get

When You Reach Out To Us

|

|

an in-depth analysis to let you understand your current financial position. |

|

|

a detail financial calculation that includes affordability, estimated capital outlay, and also takes into consideration of all the costs involved! You’ll never get shocked with any extra hidden charges! |

|

|

a customised analysis to filter the many options to determine the best value property tailored to match your budget and future plan. And generate a curated list of best buys in today’s market with good growth potential. |

|

|

how to pick the best unit in new launches or resale. |

|

|

determine the Exit Strategy. |

|

|

the Rentability and Resale ability. You do not want to end up buying a property without any tenants demand and/or resale buyers. |

|

|

advise what kind of property you should never buy and what pitfalls to avoid ! |

|

|

devise an investment ‘Asset Restructuring Roadmap’ crafted in phases to meet your financial goal. |

an in-depth analysis to let you understand your current financial position.

a detail financial calculation that includes affordability, estimated capital outlay, and also takes into consideration of all the costs involved! You’ll never get shocked with any extra hidden charges!

a handheld walkthrough of the insightful Analysis to find the best value property that suits you right now. A curated list of best buys in today’s market with good growth potential.

how to pick the best unit in new launches or resale.

determine the Exit Strategy.

the Rentability and Resale ability.

You do not want to end up buying a property without any tenants demand and/or resale buyers.

advise what kind of property you should never buy and what pitfalls to avoid !

devise an investment ‘Asset Restructuring Roadmap‘ crafted in phases to meet your financial goal.

Time the Market…

Is NOW the RIGHT Time to BUY ?…

Are you able to identify which part of the property cycle we are in now? Should you ride on the PEAK trend OR should you give a miss and wait to catch another boom ?

SAY HELLO,

Get In Touch

Let Our Experience & Vast Network Work for You

In adherence to the Personal Data Protection Act 2012 of Singapore (“PDPA”), by submitting your personal particulars through the forms in this website, you agree to allow us to contact you via the contact information you have provided.

This site is protected by reCAPTCHA and the Google Privacy Policy and Google Terms of Service apply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Google Terms of Service apply.